SECTOR Market Watch .com

Cyclical Stocks

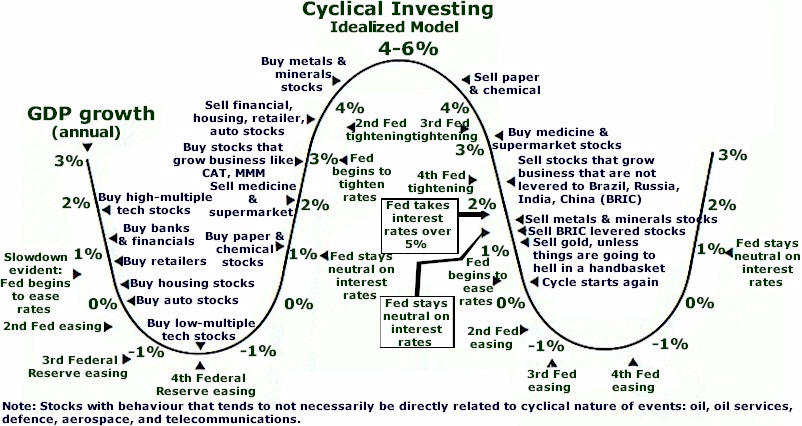

A cyclical company will have peaks and valleys at different stages of economic activity and a complete business cycle may take years to complete. Cyclical companies often exist along industry (sub-sector) lines; examples are… airlines, automobile manufacturers, furniture, heavy machinery, hotels & resorts, pulp & paper, steel. Cyclical companies are called “cyclicals” because their share prices and profits tend to follow the up and downs of the economy. They suffer when the economy is in a downturn and flourish when the economy roars. Cyclicals make less than stellar buy-and-hold investments as their stock prices are prone to tumble when the economic outlook turns bleak and may take a very long time to recover to the value they once had.

Predicting future economic health is tricky, but traders and investors that speculate on future economic health by timing cyclicals can make lots of money if they are right - and conversely lose if they are wrong.

Traditional economics reason that cyclical stocks fare best when interest rates are falling as falling rates usually stimulate the economy. On the other hand, in times of rising interest rates, cyclical stocks will respond weakly. Astute economists, traders, and investors caution that the first year of falling interest rates is not necessarily the right time to buy cyclicals as they tend to outperform growth stocks in the “last” year of falling interest rates (just before they begin to rise again).

In order to stack the odds in ones flavour many traders will look for a cyclical company in an industry/sub-sector that is due for a rebound and stick with attractive well known large companies. Larger companies more often than not provide more stability, predictability and liquidity, alternately your strategy may be to search for more volatile smaller companies that can potentially offer more impressive return.

A review of a company’s cash position is also advisable for investors speculating the end of poor economic conditions; the more cash available to buffer the storm until good times materialize, the better. Cyclicals respond more violently than growth stocks to economic changes; cyclicals can encounter enormous losses during harsh recessions and can have a difficult time surviving until the next boom. However, when things do start to improve, spectacular swings from a deficit position to profit can occur and richly reward those that timed the market correctly in advance and had the courage to pull the trigger.

Investing based on low P/E multiples is not necessarily a good key indicator for cyclicals as earnings of cyclical stocks tend to fluctuate a lot and thus make P/E a less significant measure for investing. Cyclicals with low P/E multiples can commonly turn out to be a hazardous investment as a high P/E normally marks the bottom of the cycle, while a low P/E multiple often indicates the conclusion of an upturn. Price-to-book multiples are better to use than the P/E as prices at a discount to the book value offer an encouraging sign of future recovery. When recovery is already well underway, these cyclicals will usually get several times the book value. An example would be semiconductors trading at 3 or 4 times book value at the peak of a business cycle.

Not all cyclicals will typically move at once; cement, petrochemicals, pulp and paper type companies are inclined to stir higher first. Once the recovery appears on track, cyclical technology stocks such as semiconductors usually follow. Then nearer the end of the business cycle are normally consumer companies, such as retail apparel, airlines and auto makers.

A good buy-signal is “insider buying”; senior management and directors will, near the bottom of a business cycle, demonstrate their confidence in the company’s eventual recovery and good fortunes by buying stock. They are closest to the company and have a pulse for the business they navigate thus their actions should be watched.

Other recommended reading: - The Basics